Treading on thin ICE

Smaller UK operators' survival fears in Barcelona; Kalshi ruling, Super Group & Co

Hello, on Gaming&Co today:

On the (wet) ground at ICE: Tax and black market concerns abound

Prediction markets: Landmark Kalshi ruling, Polymarket banned again

Results: Super Group hails “robust growth” in 2025

Future of Racing: BHA and Flutter update on ‘Future of Racing’ initiative

News shorts: G&Co correction, Winamax, Danish ad ban, Allwyn

Subscribe to Gaming&Co!

Aye aye ICE

Dark mood of UK executives matched Catalan weather, but rest of market buoyant

ICE cold: The miserable Barcelona weather was a good illustration of the prevailing mood among some of the contacts Gaming&Co met at ICE this week. In contrast to last year’s dry and sunny weather, this year’s edition was cold, grey and very wet (especially for the unlucky exhibitors who were situated below leaky parts of the Fira’s expo hall roof) and, while suppliers’ stands once again outdid themselves for size and ‘epic’ themes, there was no denying that the mood, especially among UK executives, was apprehensive following the respective 90% and 67% tax hikes on online casino and sports betting.

Exit strategies: Many of them, especially small and midsize operators that make up around 30% of the UK market according to the analyst team at Jefferies, were in Barcelona to meet with potential investors or acquirers.

Illegal benefits all round: One of them reiterated a point that was made to this reporter during SBC Lisbon last September that UK affordability checks had already led to the loss of much of their VIP business to crypto operators. “It’s a trend that is very widespread across all European markets, so you can imagine the scale of the phenomenon.”

Playing devil’s advocate: Even arguing that the tax rise brought the UK to tax levels comparable to those in many European markets, one contact said “the issue is that small and midsize operators will not be able to generate profits and keep operating in the market”.

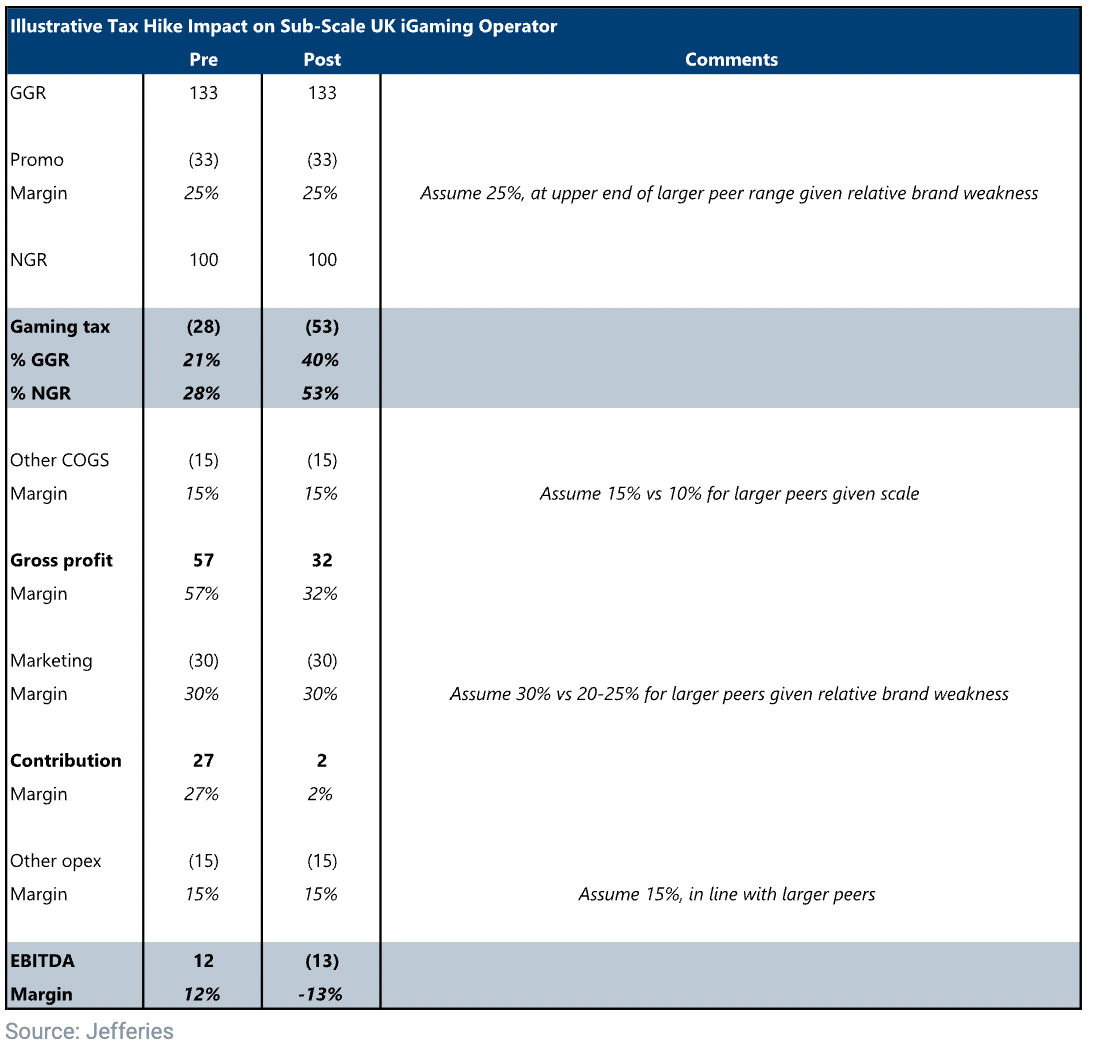

This point was illustrated by a recent Jefferies graph (below) that showed that the “hike in UK iGaming tax is more than enough to wipe out profitability of sub-scale operators”, the analysts said.

The next UK general election is not until 2029, so there is little chance of a positive change from politicians for the industry, other than the pressure that would come about as a result of reduced “sports funding” from struggling bookmarks, with horse racing in particular in the cross-hairs.

Jefferies added “while Flutter (25%), Entain (13%), Intralot (11%) and evoke (9%) and other large operators (11%) hold a collective 69% market share, we estimate that the remaining 31% is held by (more than) 2,000 smaller operators”.

Increased concentration of market share was likely, the analysts added, and would mirror other European markets. “For example, the top three operators hold c80% market share in Poland, where tax is set at 12% of handle (which equates to around 50% tax on GGR),” Jeffries said. “This compares to a c50% share held by the top three operators in the UK, prior to any effects from the recent tax hikes.”

Other ICE matters

Cold and wet, for some: While the mood among some attendees was not positive as to their outlook, that was not the case for the majority of contacts Gaming&Co spoke to. And one theme that was clear was that some of the largest unregulated market operators and suppliers were making moves towards regulated B2B markets. Expect more news on that front in the near term.

Illegal eagles: As ever though, much of the ‘floor talk’ focused on the size of the illegal market. To understand that, all one had to do was look at the gigantic stands of many of the most well-known industry companies, as well as those of so many crypto, crash games or pan-European/Asian or American casino affiliates as part of iGB Affiliate, to understand that unregulated/illegal/black market iGaming is going nowhere.

The Conexus Group is dedicated to driving growth and success across the global iGaming industry, including helping land-based and retail casinos transition online. Our key brands — Pentasia, Partis, iGaming Academy, and Incline — deliver specialised human capital solutions, M&A advisory, strategic consulting, training and managed services.

Conexus builds long-term relationships and provides deep sector knowledge, including expertise in the French market, to solve complex challenges. By orchestrating these services under one group, Conexus offers clients a streamlined partnership for enhanced performance and sustainable success.

Contact us for more information.

Kalshi facing Massachusetts ban after court order

Judge’s ruling marks first time a court has ordered a prediction markets platform to cease trading

Getting serious now: A Massachusetts judge dealt a potentially significant blow to prediction markets this week, issuing an injunction that blocks Kalshi from offering sports-related event contracts in the state. The ruling sides with Massachusetts Attorney General Andrea Joy Campbell, who argued in a lawsuit filed in September that Kalshi’s sports markets - which represent around 90% of its trading volume - amount to unlicensed gambling under state law.

CFTC not above state law : The court rejected Kalshi’s claim that its designation as a federally regulated derivatives exchange under the Commodity Futures Trading Commission pre-empts state-level oversight.

Unless the injunction is stayed or overturned on appeal, Kalshi will be forced to withdraw its sports contracts from the state, marking one of the first successful judicial interventions against a major prediction market operator in the US.

NY joins the party: The announcement was quickly cited as supporting evidence by the New York State Gaming Commission (NYSGC), which has its own ongoing case against Kalshi. The NYSGC used ‘supplemental authority’ to ask the court to consider a ruling in another court that supports its position.

Elsewhere, rival platform Polymarket has been banned from operating in Hungary and Portugal, adding to a list of countries that have blacklisted the firm, including Ukraine, Romania and Belgium.

In the zone: But despite this growing regulatory pressure, the prediction platforms continue to invest in commercial partnerships, with the latest move seeing Polymarket signing a deal with streaming giant DAZN.

The agreement will see Polymarket’s live prediction data integrated across DAZN’s platform, allowing viewers to track real-time market probabilities alongside sports content. Subject to regulatory approvals, the partnership also opens the door to prediction trading being embedded directly within DAZN’s ecosystem.

Founded in 2005, Play’n GO is a global leader in casino entertainment, known for iconic games like Book of Dead and Reactoonz. A pioneer in mobile gaming, the company delivers 350+ premium titles across 30+ regulated jurisdictions. Committed to a fun, responsible iGaming industry, Play’n GO collaborates with operator partners, regulators, and researchers to provide the world’s greatest casino gaming experience. Having expanded into music via its Play’n GO Music brand, Play’n GO is also a proud partner of MoneyGram Haas F1 Team. For more info, visit www.playngo.com

Super Group points to “robust growth” in 2025

Betway and Spin operator expecting FY revenue of between $2.17bn and $2.27bn

A positive spin: Super Group hailed “record highs” for sports bets, deposits and monthly active customers last year as it reaffirmed its FY 2025 financial guidance and announced a special cash dividend. In a preliminary business update, the Betway and Spin owner said it now expects revenue of between $2.17bn and $2.27bn, with adj.EBITDA of $555m to $565m, consistent with previously stated targets.

These figures reflect what management described as a year of “robust growth”, underpinned by strong performance in the casino segment and sustained engagement metrics across the group, despite some punter-friendly outcomes in Q4.

“We are very pleased with our performance this year,” CEO Neal Menashe said. “Casino outperformed, while sports wagers, deposits and monthly active customers all reached record highs. Customer-friendly results reduced sports hold late in the fourth quarter, yet our operating model remains very strong.”

The board declared a special dividend of $0.25 per ordinary share, payable on February 9 to shareholders on record as of February 2.

At an Investor Day last September, Super Group revealed plans to add Jackpot City to the Spanish market and launch in regulated markets in Ireland and Ontario, Canada, in the second half of 2026.

Kambi is a leading provider of premium sports betting technology and services, empowering operators worldwide with cutting-edge sportsbook products. Renowned for its powerful data-driven sportsbook platform, flexible modular technology and proven risk management, Kambi helps partners deliver world-class betting experiences. With a focus on integrity, innovation and scalability, Kambi drives sustainable growth for regulated operators across global markets. Discover how Kambi can elevate your sportsbook offering — visit Kambi.com to learn more.

BHA and Flutter update on ‘Future of Racing’ initiative

Over 100 start-ups apply for Dragon’s Den-style investor event in London

Under starter’s orders: The British Horseracing Authority (BHA) and Flutter have updated on their joint ‘Future of Racing’ initiative, revealing they have narrowed a field of more than 100 start-up applicants to 11 finalists who will pitch to investors at Dragon’s Den-style event on February 10 in London. The scheme aims to drive fan engagement and improve the race day experience as part of broader efforts to future-proof the sport amid audience and betting market shifts.

The event follows findings from the BHA’s ‘Project Beacon’ survey of 7,500 respondents, which highlighted barriers to growth including perceived complexity of betting and weaker emotional connection with younger audiences.

To combat these issues, the Future of Racing is seeking ideas on technology to enhance equine safety and welfare; simplify the sport for newcomers; improve the value of attending live events; and offer behind-the-scenes access to the racing world.

The scheme reflects a wider trend of attempts to address falling racing audiences across Europe. In France, heritage operator PMU is pursuing its own modernisation agenda, under the “Pacte PMU 2030” programme aimed at boosting stakes and diversifying beyond traditional tote betting.

News shorts

Correction: Gaming&Co’s lead English-language story on Tuesday mentioned that Titanium Brace Marketing Limited, the company involved in player refund cases in Europe, was part of FDJ’s Unibet group. That is not the case and we’re happy to make that clear.

Denmark has formally submitted a package of sweeping gambling advertising reforms for EU review, including a “whistle-to-whistle” ban on ads from 10 minutes before to 10 minutes after live sporting events and a restriction on ads near schools and on public transport. The proposals also include the prohibition of the use of celebrities, influencers and lifestyle messaging in gambling marketing and restrictions on affiliate marketing and social media promotions.

Winamax has renewed its partnership with Hexagone MMA, the French mixed martial arts league that will see the iGaming operator strengthen its presence on the country’s MMA scene through the league’s digital platforms, campaigns and events and providing betting markets and live coverage and highlights of fights.

Allwyn has said it is undertaking a major digital overhaul of the UK National Lottery, taking its website and apps offline for around 24 hours this weekend to implement “significant improvements” aimed at modernising its digital offering and player experience. The update will introduce a broader range of games, a simplified interface for playing and checking results, and enhanced responsible-play tools including deposit limits and session reality checks.

Calendar

Results: Jan 27: Evoke, Feb 5: Evolution, Betsson

Contact

Get in touch with Jake Pollard to find out more about Gaming&Co: jake@gamingandco.info