FDJ's new chapter, ANJ's RG campaign

New start for FDJ, ANJ: RG reminder & tennis growth, Crypto sponsors, UK stats wars &Co

Good morning, on Gaming&Co today:

France roundup: FDJ’s new corporate outline as regulator ANJ firms up RG reminder during French Open

Crypto on the rise: trading brands focus on sports sponsorship as crypto-gambling growth continues

With stats you can say anything: UK Gambling Commission warned about survey methodology

News shorts: Italy, Playtech, Betfair

Subscribe to Gaming&Co!

France roundup: FDJ’s new chapter, ANJ’s RG French Open campaign

FDJ highlights diversity of activities, ANJ RG campaign coincides with rising betting popularity for tennis

New beginnings: FDJ United has set out its vision to open “a new chapter” in its corporate life as it aims to become a more digital and international-focused operator following its Annual General Meeting at the end of last week. The group pointed to expansion in “new geos” and diversifying revenue streams to “commit to a renewed collective vision”.

Having unveiled its new brand name in March, FDJ said it would remain faithful to its “commitment and convictions” of “creating positive impacts on society” by being the embodiment of responsible real money gaming.

Work to do: However, as FDJ closed its acquisition of Kindred at the end of 2024, all the fines and penalties the group received in recent months have focused on the online betting and gaming group, with its Australian subsidiary Betchoice fined AU$1m (€569,000) last week.

Diversification through M&A: FDJ United has acquired ZETurf, Premier Lotteries Ireland and Kindred Group and, to divest its B2B activities, sold Sporting Solutions to Betsson, in the past three years.

CEO Stéphane Pallez said: “In all the diversity of our businesses, in all the countries where we operate, I hope that it will guide our steps, our thoughts and our actions on a daily basis.”

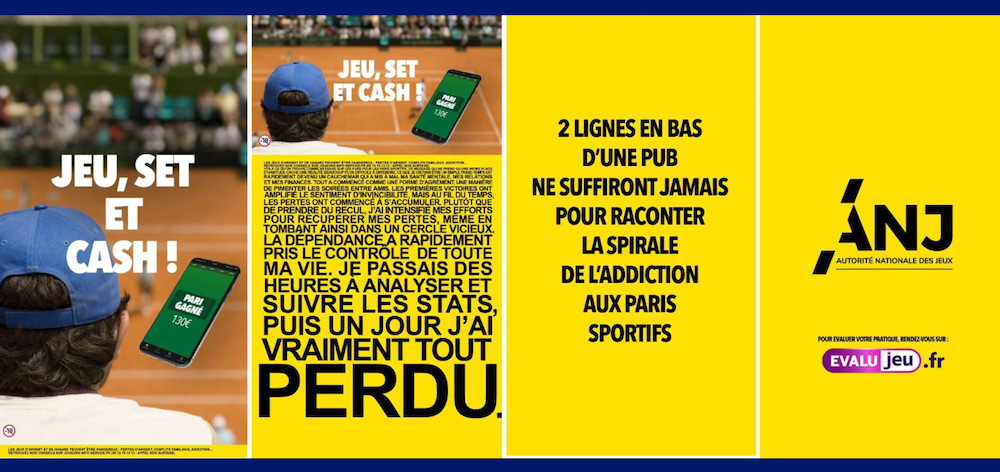

ANJ campaigns on RG during Roland Garros

Call coincides with rise in betting popularity of tennis

Campaign priority: The Autorité Nationale des Jeux has renewed its campaign promoting and raising awareness for responsible gambling during the French Open. The campaign is part of ANJ’s three-year, high priority plan to reduce the number of problem gamblers in France. The regulator said there were an estimated 1.17 million problem gamblers in France, with 810 000 at moderate risk and 360,000 at high risk.

The figures cover 2023 and were collated by the French Observatory for Drugs and Addictions. They represent approximately 5% of the country’s gamblers, a figure that “has not changed significantly since 2019”, the Observatory added.

ANJ noted that while most punters were recreational and in control, “sports betting represents the greatest individual risk of problem gambling”. “The proportion of problem gamblers is 6 times higher than for lottery games (5.9% for sports betting),” added ANJ.

Winning serve: The information comes at a time when the popularity of tennis as a sport to bet on is increasing. ANJ’s 2024 report revealed that stakes on the sport were up 18% YoY to €2.2bn and GGR rose 10% to €349m in 2024, although both stake and GGR market shares were down slightly to 22% and 20%.

Founded in 2005, Play’n GO is a global leader in casino entertainment, known for iconic games like Book of Dead and Reactoonz. A pioneer in mobile gaming, the company delivers 350+ premium titles across 30+ regulated jurisdictions. Committed to a fun, responsible iGaming industry, Play’n GO collaborates with operator partners, regulators, and researchers to provide the world’s greatest casino gaming experience. Having expanded into music via its Play’n GO Music brand, Play’n GO is also a proud partner of MoneyGram Haas F1 Team. For more info, visit www.playngo.com.

On the rise: crypto sports sponsorships and gambling

Sports marketing raises crypto awareness as gambling sponsorship bans loom

Sport drives brand awareness: Crypto trading firms have increased their sports sponsorship spend by 20% YoY to $565m, according to a new report by the sports marketing agency SportQuake. The trading platform Crypto.com remains the industry’s biggest spender thanks to its deals with the UEFA Champions League and Formula 1 taking its total expenditure to $213m.

Coinbase and OKX are also among the top three spenders and Gate.io made its entry into fourth place with its $53m F1 partnership with Red Bull and sleeve sponsorship of Champions League finalists Inter Milan, while Kraken continues to invest heavily in sports sponsorship.

Football is the most popular sport for crypto exchanges with 20 of the 34 new crypto sponsorships, but F1 continues to see increased investment from the exchanges at $174m.

Sportquake said it expects to see marketing budgets soon reach the record 2022/23 levels of $685m. CEO Matt House commented that on a macro-level, “all the growth is from football (soccer) and non-US spend in global sponsorships and international markets while they wait to see President Trump’s US crypto policies”.

Super sub: With gambling sponsorship bans either already or soon to be in place, he added that “crypto exchanges are likely to become major front-of-shirt buyers, as the Premier League’s ban on betting companies purchasing this inventory takes effect in the 2026/27 season”.

Crypto-gambling rise continues

The scale of crypto-gambing is undisputed today, even if the size of the market and its revenues are hotly debated. The topic came to a head recently when the Financial Times cited figures estimating crypto GGR at more than $80bn. These were rejected by industry experts and Tim Heath, founder and partner of Yolo Investments, which counts operators such as Sportsbet.io and Bitcasino.io on its roster, chipped in with his own take this week.

Removing friction: As crypto-gambling firms continue growing, some industry observers commented that they are outperforming traditional operators on the “fundamentals”, such as “instant withdrawals” and “streamlined sign-up flows without heavy compliance friction”.

Removing pain points: For others, however, when operators remove “friction” points “like KYC and responsible gaming and paying taxes, somehow your business does better”.

The Conexus Group is dedicated to driving growth and success across the global iGaming industry, including helping land-based and retail casinos transition online. Our key brands — Pentasia, Partis, iGaming Academy, and Incline — deliver specialised human capital solutions, M&A advisory, strategic consulting, training and managed services.

Conexus builds long-term relationships and provides deep sector knowledge, including expertise in the French market, to solve complex challenges. By orchestrating these services under one group, Conexus offers clients a streamlined partnership for enhanced performance and sustainable success.

Contact us for more information.

Stats wars

UK watchdog urges Gambling Commission to be transparent in data interpretation

No whitewash: The Gambling Commission has been urged not to “whitewash” criticism after the official UK statistics watchdog raised concerns over the reliability of its flagship Gambling Survey for Great Britain (GSGB). The Office for Statistics Regulation (OSR) review into the GSGB followed industry complaints about the survey’s methodology, transparency, and possible overestimation of gambling harm.

Battle of the numbers: The GSGB recorded substantially higher rates of gambling participation and harm than other official studies, such as Health Survey for England, and industry bodies have raised concerns that it might lead to inappropriate policy decisions.

The OSR stopped short of declaring breaches of statistical standards, but urged stronger adherence to its code of practice and issued nine key recommendations to enhance the survey’s reliability. In its response, the UKGC said it welcomed the OSR’s findings and was already taking steps to address concerns, including better user guidance and new methodological research.

But Regulus Partners hit out at the Commission for not addressing criticism head on. “The initial response is not encouraging,” the analysts said. “It has either misinterpreted the OSR’s review or chosen to misrepresent it - neither of which can foster trust. Those who whitewash criticism are unlikely to learn from it.”

A full UKGC response is due by July, ahead of the next GSGB report in October 2025.

News shorts

Italy’s gambling GGR rose 4.4% to €21.6bn, driven mainly by the growth of the online sector, which saw a 17% uplift in GGR to €5bn in 2024. Retail gambling GGR increased modestly from €16.3bn to €16.5bn, while online betting volumes outpaced other channels as total digital wagers exceeded €92bn vs. €65bn for land-based gambling. Tax revenues were steady at €11.6bn - confirming the sector’s contribution to the Italian Treasury.

Roberto Alesse, DG of the regulator ADM, said the Italian sector’s “resilience and fiscal importance are evident”. “But it is equally important that our oversight remains rigorous, particularly as the market becomes more digitised.” Enforcement activities by ADM intensified in 2024, it issued 3,319 administrative sanctions and blocked 721 unlicensed gambling websites. Enforcement actions linked to taxes reached €72.5m.

Playtech has finalised the sale of its German retail brand HappyBet to NetX Betting, a subsidiary of the Pferdewetten AG, as part of its move to focus on its B2B activities. The group did not reveal the amount of the transaction and had planned to close HappyBet if a buyer could not be found. Pferdewetten operates the Sportwetten brand in Germany. HappyBet recorded an adj. EBITDA loss of €12m in 2024 due to increased costs, although revenues rose 4% to €19m.

Betfair has closed its affiliate programme in the UK and Ireland due to “a series of changes to the UK&I market and an increasingly complex regulatory landscape”. The group's parent Flutter Entertainment will instead consolidate its affiliate services onto one platform to increase efficiencies. It told SBC News the decision was “part of a broader move toward a centralised affiliate platform within Flutter UK and Ireland. These changes will enhance compliance standards and operating efficiencies for Flutter”.

The 2025 Gaming in Spain Conference, which will take place June 26 in Madrid, is THE event where international and domestic stakeholders in Spain's regulated online gambling market meet.

This year's edition will feature Mikel Arana, Director General of the DGOJ, as the event's keynote speaker. In addition to our usual focus on the Spanish market, the 2025 Gaming in Spain Conference will also feature sessions and speakers from the most promising LATAM markets.

Don't miss it! Register now

Calendar

Events: 10-12 June: SBC Summit Malta, 5 Jun: Gaming in Holland, Amsterdam, 26 Jun: Gaming in Spain, Madrid

Contact

Get in touch with Jake Pollard to find out more about Gaming&Co: jake@gamingandco.info