Better Collective's tough start to 2025

Brazil's early steps for BC; results: Gambling.com, Codere, CIRSA; Europe's blurred sponsorships; US war of words &Co

Good morning, on Gaming&Co today:

Results: Better Collective hit by regulatory costs in Brazil

Analysts welcome Gambling.com Q4 news

Codere Online and CIRSA revenues up

Friday focus: Sponsorship confusion in Europe

Sweepstakes war of words in US heats up

News shorts: Italy accelerates, more Entain execs exit

Subscribe to Gaming&Co!

Brazil’s regulatory costs to hit Better Collective

Affiliate giant talks up Brazil, but early steps and tough comps will drive EBITDA drop

Early days in Brazil: Better Collective CEO Jesper Søgaard said the company’s activities in the next 12 months will be impacted by Brazil’s market regulation as taxation, NGR costs and customer churn will drive a short-term “50%-70% decline in Brazilian revenue share” that will impact 2025 EBITDA by €35m-€50m.

He reconfirmed FY25 guidance of €320m-€350m and EBITDA of €100m-€120m and that cost-cutting measures during Q4 had seen the group shed 300 employees. The measures also led to a €15m EBITDA contribution during the period.

Focus on Americas: The company’s focus is now firmly on Brazil and the US; those two markets generate more than half its revenues, the group said.

Søgaard added that Brazil was in its “very early days” but that BC was “excited about Brazil in the coming years due to the leading position we have in this market and we expect it to become a strong growth driver for us”.

Tough comp: The cost-cutting is expected to drive savings of €50m in 2025, but the €20m EBITDA generated in H124 thanks to high US activity (North Carolina launch) and Euro 2024 will provide “a tough comparison” with this year.

Absolute numbers: Better Collective added that it “expects absolute growth in its European, Esport, South America (ex-Brazil) and Canadian businesses and the US growing from its lower baseline”.

Longer term, BC expects positive organic growth from 2026 helped by the World Cup in North America, “the biggest betting event every time it happens”, said Søgaard, and EBITDA margins before special items at 35%-40% for 2027.

Gambling.com praised on its execution

Affiliate does what it says it is going to do, say analysts

Scarcity factor: The analyst team at Jeffries welcomed Gambling.com’s preliminary Q4 revenues of $35m and adj. EBITDA of nearly $15m (42% adj. EBITDA margin). Jeffries said the company’s FY25 guidance was “a vote of confidence in the growth story as guidance implies 35% and 40% YoY growth in revenue and adj. EBITDA respectively, which is rare in our coverage”.

Mas o menos: Gambling.com's adj. EBITDA was “slightly above our $14.5m and the Street's "$13.4m”. But its “net income of $7.8m” missed both Jefferies’ $8.9m and the Street's $8.7m forecast, “likely due to elevated deal expenses associated with the OddsJam acquisition”.

FY25 revenue and adj. EBITDA guidance was in line with expectations at $170m-$174m and $67m-$69m respectively.

Jefferies noted that the group’s “setting, meeting and beating” of expectations and “selective acquisitions” such as OddsJam has seen its share price rise 82% in the past year.

🧗 Gambling.com’ share price

Codere, CIRSA revenues rise

Codere Online saw FY24 revenues rise 23% to €211.5m as Spain revenues increased 16% to €88m and Mexico was up 30% to €107m with fourth consecutive quarter adj. EBITDA of €6.4m, at the higher end of its €2.5m-€7.5m forecast. During Q4 however “the significant devaluation” of the Mexican peso led to flat quarterly revenues, but group NGR was up 5% YoY to €52.6m during the period.

The company plans to buy back $5m worth of its shares and said it has obtained an extension to regain compliance with the Nasdaq stock exchange subject to it filing its 2023 annual report on or before 12 May 2025.

Meanwhile, CIRSA recorded a 14% increase in net revenues to €586m and an EBITDA rise of 17% to €191m in Q4 thanks mainly to retail casino segment growth in Peru and Mexico, while its acquisitions of Apuesta Total and CasinoPortugal diversified its revenue streams and opened new markets for the company. FY24 net revenues were up 10% to €2.1bn and EBITDA was up 11% to €699m. CIRSA said the increased gambling tax in Colombia has not yet impacted its activities in the country.

Goma Gaming delivers the next generation of iGaming tools, led by its flagship product, GomaUX, which is an AI-driven sportsbook front-end framework. GomaUX enables all operators to deliver Tier-1 user experience, combining ultra-low latency architecture, swipe/scroll navigation, unified cross-platform publishing (iOS, Android, Web), alongside bet builder, cashout, cashback, loyalty, bonusing, gamification, social media sharing and odds-boost.

GomaUX can be infinitely customised to suit any operator’s functional or visual requirements, and enables total operator control via Goma’s CMS, removing the need for dev work to enable event-driven changes.

Contact us for more information.

Betano was the official Euro 2024 betting partner

Europe’s blurred vision on sport sponsorships

Sport sponsorships provide visibility for operators and much-needed funds for clubs, but these are all at risk following regulatory moves in the Netherlands, Belgium and France

Leaders: The gambling industry has by far been the most active sponsor in the European football market in recent years, with 42 unique team deals across the top 10 leagues in 2023/24, worth an estimated annual value of over £100m, according to analytics firm Global Data.

But as European lawmakers enact ever more stringent regulations on advertising and sport sponsorships, the industry is getting hit on its ability to advertise openly in regulated markets.

Disappointing channelisation: In Belgium, the restrictions have had the perverse impact of leaving the field open to illegal operators, while the Dutch regulator, rather than an industry lobby group, explained that new restrictions have led to channelisation rates of just 50%.

Meanwhile, France is not banning advertising, but its 15% levy on media spend is causing major worries for sports clubs at all levels.

Read the full feature on SBC News

Founded in 2005, Play’n GO is a global leader in casino entertainment, known for iconic games like Book of Dead and Reactoonz. A pioneer in mobile gaming, the company delivers 350+ premium titles across 30+ regulated jurisdictions. Committed to a fun, responsible iGaming industry, Play’n GO collaborates with operator partners, regulators, and researchers to provide the world’s greatest casino gaming experience. Having expanded into music via its Play’n GO Music brand, Play’n GO is also a proud partner of MoneyGram Haas F1 Team. For more information, visit www.playngo.com.

Sweepstakes hit back at American Gaming Association

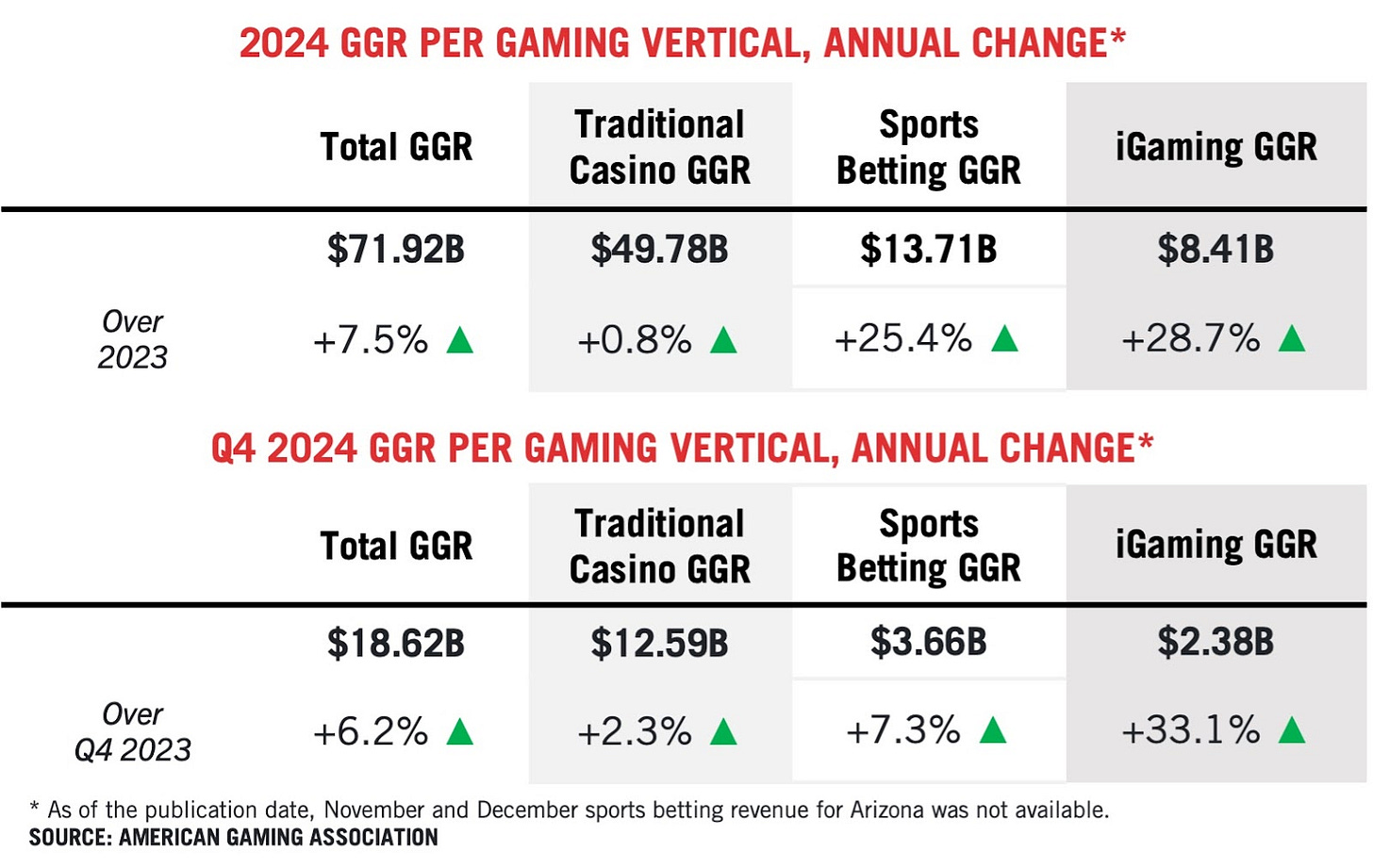

🎙️🎤🔊 The war of words between the American Gaming Association, ‘traditional’ stakeholders and sweepstake operators continued this week following AGA President Bill Miller’s comments during its State of the Industry release.

Miller said that sweepstakes “appear to bypass or circumvent state gaming, from currency exchanges to digital asset platforms” and “deploy legal acrobatics to avoid calling themselves betting or gambling”.

Immediate response: The Social and Promotional Games Association issued a statement describing Miller’s claims as “many of the same tired canards about social sweepstakes that self-interested critics have peddled for months”.

The SPGA added that “properly operated sweepstakes are legal in almost all states” and that its “members operate within well-established legal frameworks that contrast starkly with black-market offshore sportsbooks and casinos”.

🍿The claims follow an amusing exchange between Light&Wonder’s Howard Glaser, possibly sweepstakes’ biggest foe, and the SPGA’s Chris Grove last week.

AGA figures revealed that US gaming revenue was up 7.5% YoY and reached a record of $71.9bn in 2024, with Q4 enjoying a single-quarter record of $18.6bn (see below).

News shorts

Italy is set to record €5bn in GGR in 2024, a YoY increase of 11%, with online gambling (casino, poker and bingo) up 16% representing €3.2bn of the total, and online sports betting rising 11% to €1.8bn.

Lottomatica leads with market share of 29% while Flutter International, which acquired Snaitech for €2.3bn in Sept24 and Sisal in 2021, holds 22.7% market share and plans to increase by 7-8% this year.

The country’s new licensing regime is also set to usher in a new era for the country’s gambling sector.

Entain’s New Zealand and Australia operations have been hit by the departures of Lachlan Fitt and Cameron Rodger, respectively CEO-CFO of Entain Aus and MD of Entain NZ. Rodger only joined the company in 2023 after a 12-year stint with Tab NZ and Fitt has been CFO of Entain Aus for the past six years.

The departures come as the Australian Financial Intelligence Agency is conducting a money laundering investigation into Entain Australia, accusing the group of knowingly accepting AUD$152m (€90m) from high-risk customers linked to criminal activities.

Calendar

Results: 25 Feb: Light & Wonder, Caesars | 27 Feb: PENN Entertainment | 6 March: Banijay-Betclic, FDJ, Entain

Events: 23-25 Feb: SIGMA Eurasia Summit, Dubai | 25-27 Feb: SBC Summit, Rio de Janeiro | 12-13 Mar: NEXT NYC 2025, New York

Contact

Get in touch with Jake Pollard to find out more about Gaming&Co: jake@gamingandco.info

Thanks for reading Gaming&Co!