Dutch industry on high alert

Gaming in Holland conference, ANJ awareness campaign, Allwyn &Co.

Hello and happy Friday!

On Gaming&Co today:

Gaming in Holland: Dutch iGaming industry is on high alert as government looks at higher taxes and more restrictions.

ANJ raises awareness among 18-34 year olds ahead of Euros.

UK lottery boosts Allwyn Q1s.

News shorts: Gaming Innovation Group, NBA call for federal oversight.

Subscribe to Gaming&Co!

Dutch industry on high alert

Channelisation, growth of offshore market and reduction in player protection levels all mentioned as potential consequences of proposed regulatory changes.

Standing at the crossroads: The Dutch online gambling market is at a crossroads as major legislative changes, including a potential tax rise from 30.5% to 37.8%, a ban on “high risk” online slots, cross-operator deposit limits and a one-hour rule whereby operators must identify signs of problem gambling among their players, have been put forward by the country’s politicians and yesterday’s Gaming in Holland conference in Amsterdam zeroed on all those key topics.

Worry on my mind: The delegates and speakers criticised the proposals, with Kindred CEO Nils Anden (pictured on the right) pointing out that any tax rise would be passed on to consumers in the shape of a “decrease” in the user experience. This would “risk driving consumers to unregulated operators” and lowering channelisation rates.

Missing the target: Anden, who told Gaming & Co that he expected Française des Jeux’s proposed €2.6bn acquisition of Kindred “to be progressing smoothly”, added that the Dutch government’s target of “€200m in extra tax revenues” would not be reached if the measures contributed to “driving consumers away” from regulated operators.

Opening proceedings, the outgoing chair of the regulator KSA, René Jansen, noted that the July 2023 ban on untargeted advertising whereby 95% of players visiting gambling sites must be over 24 is “difficult to manage, implement and supervise” and the KSA is “in talks with the Ministry of Justice about these difficulties”.

See you next year (hopefully): He cautioned against lawmakers’ urge to bring in ever more restrictive regulations. “Compliance can only be realised with licensed operators and important decisions should always be made in the players’ interests”.

Jansen also reminded operators that public opinion matters and depends on them doing “the right thing” when it comes to levels of advertising or responsible gambling, so that his “successor (as KSA chair) will be speaking to you all again next year”.

Peter-Paul de Goeij, CEO of Dutch trade group NOGA, said implementing cross-operator deposit limits would be extremely difficult technically and require a change in the law, while Matthias Spitz of the German law firm Melchers, said similar measures in Germany had “led to a 70% drop in account openings” and, if implemented, would have major consequences for the regulated market in the Netherlands.

First among unequals: NOGA’s de Goeij added that “at-risk players are the first to leave the system if the limits are too strict and the first (iGaming companies) to contact them are the illegal operators”.

Event horizon: Beyond those regulatory clouds on the horizon, the delegates described the Dutch market as a success story and H2 Gambling Capital forecast that online GGR would reach €1.5bn in 2024, €1.78bn in 2026 and €2.2bn by 2029, with just 12% of the market still wagering with offshore operators in 2024.

However, the data firm added that online slots account for around 55% of the market’s GGR and a ban on the vertical “would be catastrophic for the channelisation rate of the market”.

H2 also noted that Germany’s “€1000 deposit limit, €1 maximum slot stake and high tax burden” had led to a 46% drop in “‘taxed’ iGaming activity” in Q1 vs. “the same period in 2022 post-launch” (see graph below), with a channelisation rate of just 51% compared with 89% currently in the Netherlands or 97% in Italy.

Neosurf: 20 years of excellence in payments

For two decades, Neosurf has been your reliable companion in the world of payments. Established in the heart of France in 2004, we've evolved into an industry powerhouse, setting the gold standard for pioneering yet user-friendly payment solutions.

Our French heritage underpins our commitment to excellence and innovation.

From Vouchers to Digital Wallets, from our KYC Handshake and to payouts and data sharing, our product portfolio is designed to streamline your operations and enhance the player experience.

Contact us: hello@neosurf.com, www.business.neosurf.com

ANJ launches awareness campaign ahead of Euro 2024

Campaign is part of regulator’s plan to “drastically” reduce number of problem gamblers by 2026

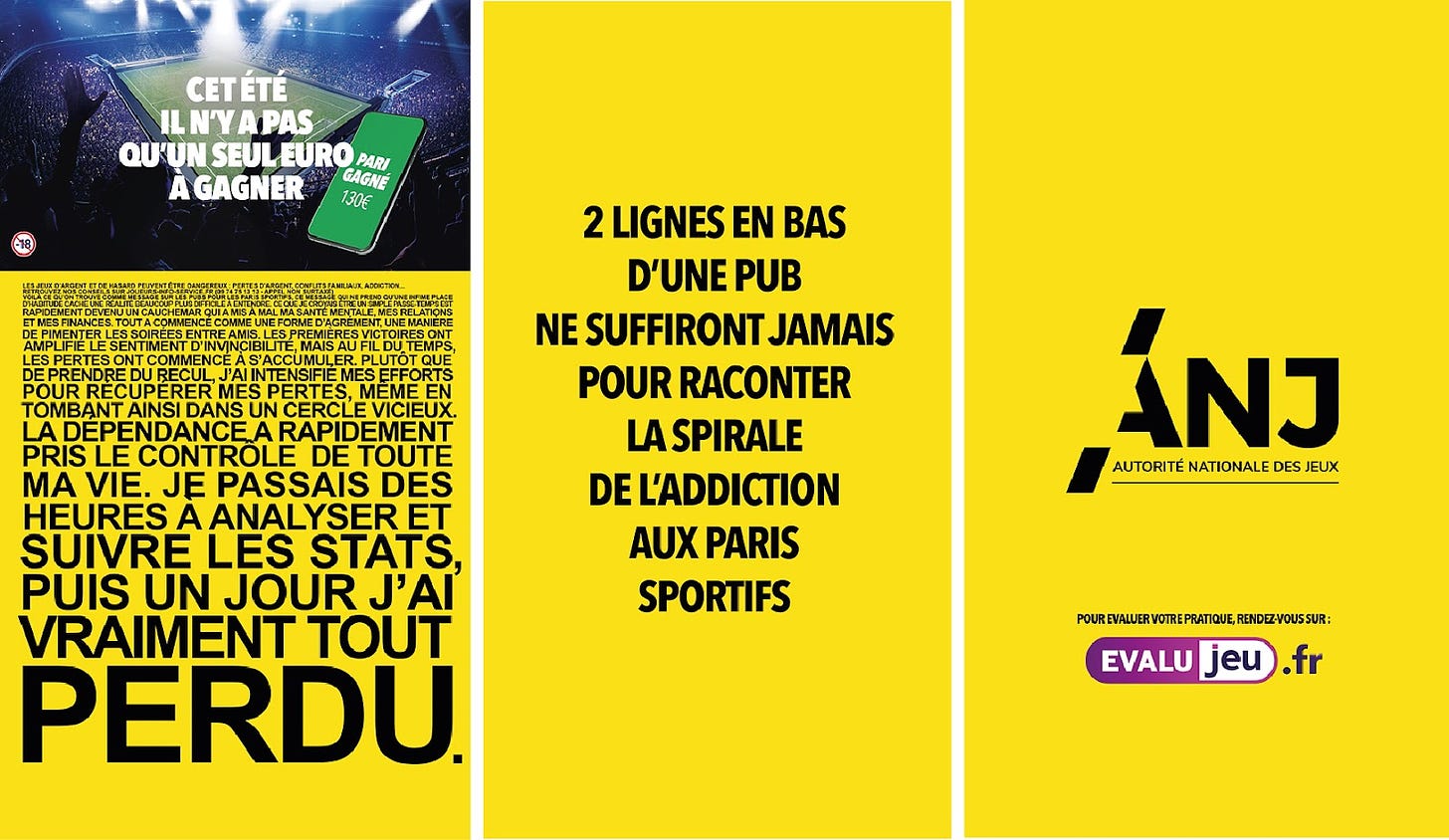

Read the small print: France’s Autorité Nationale des Jeux has launched an awareness campaign ahead of Euro 2024, reminding French players that for all the legal mentions included in advertising, these are often ignored and do not describe the real stories behind gambling addiction.

The tagline “2 lines at the bottom of an ad will never be enough to tell the spiral that is sports betting addiction” appears at the bottom of ANJ’s graphic to illustrate the dangers of excessive gambling.

A survey of just over 1,000 players by Harris Toluna revealed that 55% of French adults plan to place a sports bet during the tournament. Football generates 52% of sports wagers in France and recorded €4bn in online stakes in 2023. Euro 2020 (2021) generated €700m and the 2022 World Cup €900m, and ANJ said this year’s Euros could reach €1bn in wagers.

Nearly half, 44%, of bettors aged 18-34 plan to bet on games featuring the French team and ANJ said 82% of the respondents were aware of the risks of addiction, a rise of 9bps on 2022.

ANJ was highly critical of what it considered to be operators’ excessive advertising during the last Euros and its President Isabelle Falque-Pierrotin said they had “adjusted their practices”.

“This positive dynamic must continue during the Euros and the Olympic Games,” she added. A new study on the number of excessive gamblers is expected by the end of the year. Data from 2019 revealed that there are around 1.4 million problem gamblers in France.

UK lottery boosts Allwyn Q1s

Allwyn recorded revenues of €2.1bn in Q1, a 28% rise YoY that was “primarily driven by a full quarter contribution from UK” lottery activities, as adj. EBITDA increased 3% to €358m and total revenue grew 3%. Allwyn completed the acquisition of UK lottery group Camelot on 31 January and said it had had “a significant impact” on its revenue growth.

CEO Robert Chvatal said the group’s performance “was once again supported by good growth in digital” and “a highlight was the launch of Eurojackpot in Greece, bringing a multi-national jackpot game to our Greek players for the first time”.

During the period the company raised a €500m credit facility and more recently agreed a $450m loan to extend its maturity profile and diversify funding sources. Net debt to adj EBITDA was 2.1x at the end of March.

News shorts

Gaming Innovation Group, which recently acquired CasinoMeister for €3m, has completed a €9m share issue from its current investors and the group’s joint CEOs Jonas Warrer and Richard Carter that will be used as working capital ahead of the split between the group’s media and platform-sportsbook divisions set for Q3. The group recently appointed Phil Richards as its new CFO and signed a sweepstake partnership in the US with Primero Games.

The NBA has called for a federal framework to regulate sports betting following recent betting scandals involving ex-Toronto Raptors player Jontay Porter. The US basketball league said federal regulation could provide a higher level of transparency, help with maintaining the integrity of NBA games and that regulated sports betting had allowed the NBA to track suspicious activity.

What we’re reading: French publishers stand their ground on AI (in French).

Contact Jake Pollard to find out more about Gaming and Co: jake@gamingandco.info