Market make-up: UK bet builders and margins

Propus Partners analyses UK bet builders and margins, French casinos call out FDJ, 888, NIBS

Hello, on Gaming & Co today,

Market make-up analysis: Propus Partners gets behind UK bookmakers’ bet builders and margins.

French casinos call out FDJ on its ‘monopolistic’ advantages.

888 trading update: toughing it out.

News in brief: GIG in Latam, Betting Gaming & Council, Kindred Group.

Subscribe to Gaming & Co!

Bet builder margin analysis - UK

As part of its ongoing series of reports examining European betting markets, Propus Partners gathered data from UK bookmakers for the Premier League weekend of 12-14 January and analysed how the country’s bookmakers offered bet builders and the margins they applied to them.

Global prominence: Over the last few years, 'bet builders', or 'same game parlays', have risen to prominence in many global regions. In markets where football/soccer is popular, they have become a 'must have' feature within sportsbooks, providing customers with exciting and engaging betting opportunities within each individual event, while providing the operator with a high margin product.

As part of our analysis of the UK bet builder space, we discovered some interesting patterns:

Given the nature of the product, where all possible combinations of selections within an event simply cannot be listed due to the huge number of them, the margin that is applied is somewhat hidden.

Without an efficient way of comparing bet builder prices across a range of bookmakers, customers are left to accept or reject what they are offered and their choice is often based on their own perceptions of fairness.

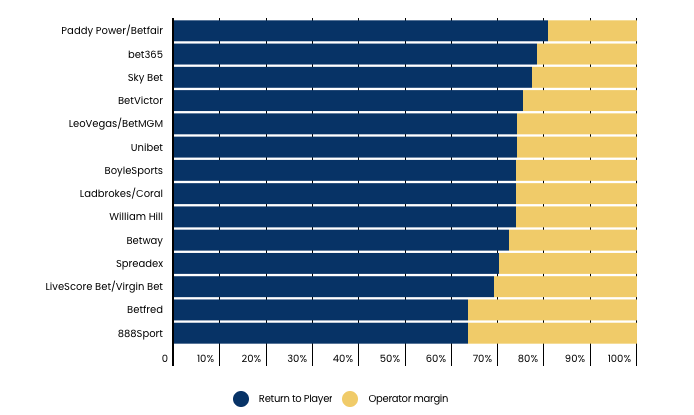

When it comes to operators, Paddy Power/Betfair, bet365 and Sky Bet have the lowest margins from the sample of matches and bets analysed.

There is a significant range of average margins across the bookmakers within the sample, ranging from 20% to 35%.

Margin applied is somewhat related to the number of selections within the bet, but not strictly so.

Bet builders with player markets included generally see higher margins applied.

The chart below shows the expected 'Return to Player' (in blue) and expected margin (in yellow) across the bets where every operator offered a price:

How was the data analysed?

We collected prices for each of the bookmakers within the sample across the five English Premier League matches that were played on the weekend of 12-14 January 2024. For each match, a sample of 10 bet builder bets were built, designed to represent a range of:

Number of selections

High and low probabilities

Types of markets (goals, corners, cards, players)

Then using Propus's proprietary bet builder algorithm, the actual (marginless) probability for each bet was calculated. Multiplying this probability with the offered prices gives the expected margin and RTP values.

What does margin depend on?

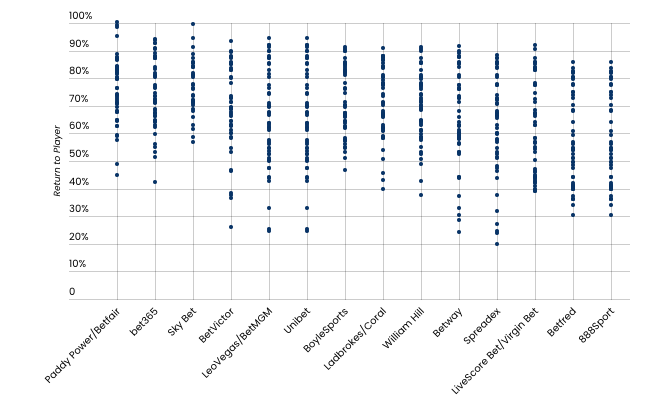

As the chart below shows, the margin applied on each bet by any given bookmaker is not static. Note, where there are common prices between operators, that will likely be due to a common supplier.

The average margin taken across all three-selection bets within the sample, across all bookmakers, was approximately 25%. For four-selection bets, this increased to approximately 40%. However, for five and six-selection bets, margin remained at approximately 40%.

From this sample, it does therefore appear that there is a correlation between number of selections and margin, however it is not as strong as it would be for standard accumulators/parlays across different events (where margin simply compounds).

A stronger correlation is seen when analysing margin compared to the number of 'types' of markets included in the bets (goals, corners, cards, player goals. For bets with just one of these 'types' included, margin is close to 20%, with two types it is approximately 30%, with three types it is approximately 35%, and with four types, 40%.

Looking at bets where a 'player' selection is included, the average margin is 35% compared to 30% where no player selection is included.

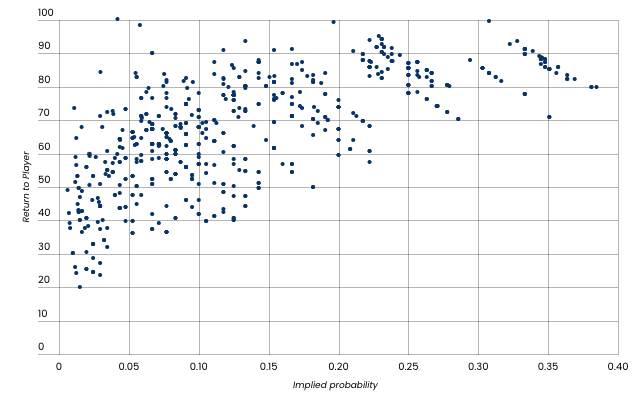

The final chart below shows how margin decreases as the probability of the bet increases, or put another way, for shorter odds bets, the customer is likely to receive more of their stake back over time.

User experience

Having spent time collecting the data for this analysis, the Propus team are of a view that some of the current bet builder solutions in the UK market are yet to achieve a simple and intuitive user experience, given the nuances of the product and the volume of markets included.

This may go some way to explaining the popularity and importance of pre-built bet builder selections for customers. Improvements in this area will help operators capture and retain cohorts of players that are yet to engage with the product due to its complexities.

Propus Partners is a consultancy specialising in sports betting with a specific focus on trading, trading technology, product, operations and the supplier marketplace. Propus works with operators, platforms, feed providers, regulators, data rights holders and sporting organisations.

Neosurf: 20 years of excellence in payments

For two decades, Neosurf has been your reliable companion in the world of payments. Established in the heart of France in 2004, we've evolved into an industry powerhouse, setting the gold standard for pioneering yet user-friendly payment solutions.

Our French heritage underpins our commitment to excellence and innovation.

From Vouchers to Digital Wallets, from our KYC Handshake and to payouts and data sharing, our product portfolio is designed to streamline your operations and enhance the player experience.

Contact us: hello@neosurf.com, www.business.neosurf.com

French casinos call out FDJ in letter to government

J’accuse : France's largest casino groups have written to the new Prime Minister Gabriel Attal excoriating Française des Jeux for its aggressive expansionary policies and the “major competitive distortions” that enable it to operate across all verticals and channels in the country.

The letter, seen by the newspaper Les Echos, was signed by the CEOs of the Barrière, Partouche, Tranchant and JOA casino groups and denounced the "major distortions of competition" that they say FDJ benefits from.

Charge sheet: These include "access (to FDJ premises) without ID, the ease with which new games can be offered, the absence of controls at points of sale, unlike casinos, and the use of the same FDJ customer account for games (offered under its) monopoly and (those operated in a) competitive context".

On that last point, FDJ told Les Echos that it will be splitting its land-based and online databases in the near future, as horse racing monopoly PMU was forced to do nearly 10 years ago.

It also emphasised "the priority given to preventing excessive gambling and gambling by minors, both in the physical distribution network and online".

Expansion drive: In recent months FDJ has acquired the Irish lottery group Premier Lotteries Ireland and the online operator ZETurf, that transaction made it one of the top four bookmakers in France. Previous acquisitions include the sports betting data provider Sporting Group and payments firm Aleda.

Delicate subject: The letter is also part of the broader and highly sensitive topic of online casino regulation. Les Echos referred to an article written by Gaming and Co that revealed FDJ was in discussions with the government to potentially be granted an exclusive licence to operate iCasino products in France.

Circle of trust: The claims were dismissed by FDJ, which said they were "unfounded", and Les Echos noted that the casinos' move could also be seen within the context of a study on the reform of gaming clubs (cercles de jeux) in Paris set to be published shortly.

Further reading: FDJ in the eye of the storm

ANJ revamps 'sports list' and authorises March Madness

New listing: The French gambling regulator Autorité Nationale des Jeux has updated the list of authorised competitions that the country's operators can offer as betting products. The new ‘sports list' was drawn up as a way to clarify the process of approving sporting events for wagering and to strengthen sporting integrity.

Two-part composition: The competitions and sporting events authorised as betting products and the types of results and phases of play relating to these competitions or events.

Notably, the numerous types of sporting outcomes that were authorised, which could be difficult to understand and connect with one another, have been brought together under more general types of outcome.

In terms of high profile competitions, operators will be able yo offer bets on the March Madness finals.

ANJ also highlighted two further changes: In basketball, bets may now be placed on the number of points scored by a player, even if it is under 20, while the restriction expressed by the type of result "Player(s) who score(s) 20 points or more" has been removed. In tennis, the ban on handicap betting has been abolished.

This part of the list was “radically modified to make it easier for operators to implement and comply with it”, ANJ said.

Question of sport: France’s gambling regulations prohibit bets that don’t rely on the bettors’ sporting expertise and knowledge, ANJ added that it decided to update the list because it had been regularly amended since France regulated its online gaming and betting sector in 2010 and had lost some of its “clarity and consistency”.

Entain sues BetCity

UK group is suing the Dutch casino group it acquired in 2023, but for unclear reasons.

Meet the Singels: Entain has filed a lawsuit against the Singels family, the former owners of BetCity, the Dutch online casino group it acquired last year for up to €450m. The suit was filed on 7 December in the UK, but the Dutch website Casino Nieuws said it was “unclear what Entain accuses the Singels family and others of”.

Casino Nieuws reports that it “concerns a so-called ‘Part 7 Claim’, a case that is usually based on a complex dispute and for which going to court is inevitable”.

“The only further characterization given is that it concerns a dispute over a commercial contract, hinting at the contract that established the acquisition of BetCity by Entain,” the website added.

Former BetCity CEO Melvin Bostelaar and Marketing Director Robert Kooiman are included in the suit. Bostelaar was replaced as CEO by the Canadian national Vic Walia in June 2023 and Kooiman left BetCity in December.

Fast mover: BetCity launched as one of the first licensed operators in the Netherlands in 2021, was snapped up by Entain in 2022 and the acquisition was finalised a year ago.

888 trading update

Revenues were down 7% YoY but up 5% QoQ to £424m, with the group pointing to regulatory and compliance issues as the main reasons for the annual drop.

New CEO Per Widerström said the group had laid the foundations for recovery, but that its “financial performance must improve”. On a full-year basis, revenues were down 8% to £1.7bn and 888’s dot com revenues were down 17% YoY to £517m. A year ago the group’s VIP business in the Middle East caused it major compliance problems and led to CEO Itai Pazner losing his job in the process.

NIBS

Gaming Innovation Group has launched two new brands: PlayR.bet, a new online casino brand targeting Brazil, and Palasino, a land-based operator with digital expansion plans in Latin America.

UK trade body the Betting and Gaming Council has urged the government to ensure frictionless financial risk checks become a reality. BGC CEO Michael Dugher said: “At the BGC we supported enhanced checks for online gambling, but have been clear throughout that checks should be carefully targeted (…) They must also remain frictionless, as punters have repeatedly made clear they will not submit to intrusive checks.”

Unibet parent company Kindred Group will be hosting its “Safer Gambling: A look into the future” event in London in March and has called on experts to join and discuss ideas of how to ensure that the industry remains sustainable and safe through and through.

Calendar

18 Jan: Flutter Entertainment

6-8 Feb: ICE London

Feb 7: Disney/EPSN Bet

Feb 29: Lottomatica

Contact

Contact Jake Pollard to find out more about Gaming and Co: jake@gamingandco.info