France full of momentum in H1

French industry up in H1, financial watchdog report, Canal+ NIBS &Co

Hello, on Gaming & Co today:

Dynamic sector: French gambling full of momentum in H1

France’s financial watchdog publishes (a quite fascinating) in-depth report on the industry

Canal+ will not bid for Ligue1 TV rights

Entain marks down Q3

News in brief : Genius Sports, EveryMatrix, Unibet

Subscribe to Gaming &Co !

French sector full of momentum in H1

The Autorité Nationale des Jeux says industry enjoyed "very good momentum" in H1.

The online and brick-and-mortar verticals in France enjoyed "very good momentum" in H1, the country’s regulator ANJ revealed in its activity report published today.

Major incumbents: Noting that FDJ and PMU accounted for 78% of total GGR, the date showed that FDJ's GGR reached €3.3bn during the period and was up 2% YoY.

ANJ said the strong performance was due to a rise in retail and online OSB, with stakes up 13% to €2.3bn, while lottery stakes were up 2% to €8.2bn.

Although lottery is usually the engine behind FDJ's GGR growth and the vertical performed well, this was “at a slower rate” than its online and retail betting activities, said ANJ.

PMU's GGR was up 1% to €873m in H1, with the group returning to a level that was close to its pre-pandeminc numbers, noted ANJ.

Dynamic trio: Meanwhile France’s online operators enojyed the "return of significant momentum in all three gaming segments".

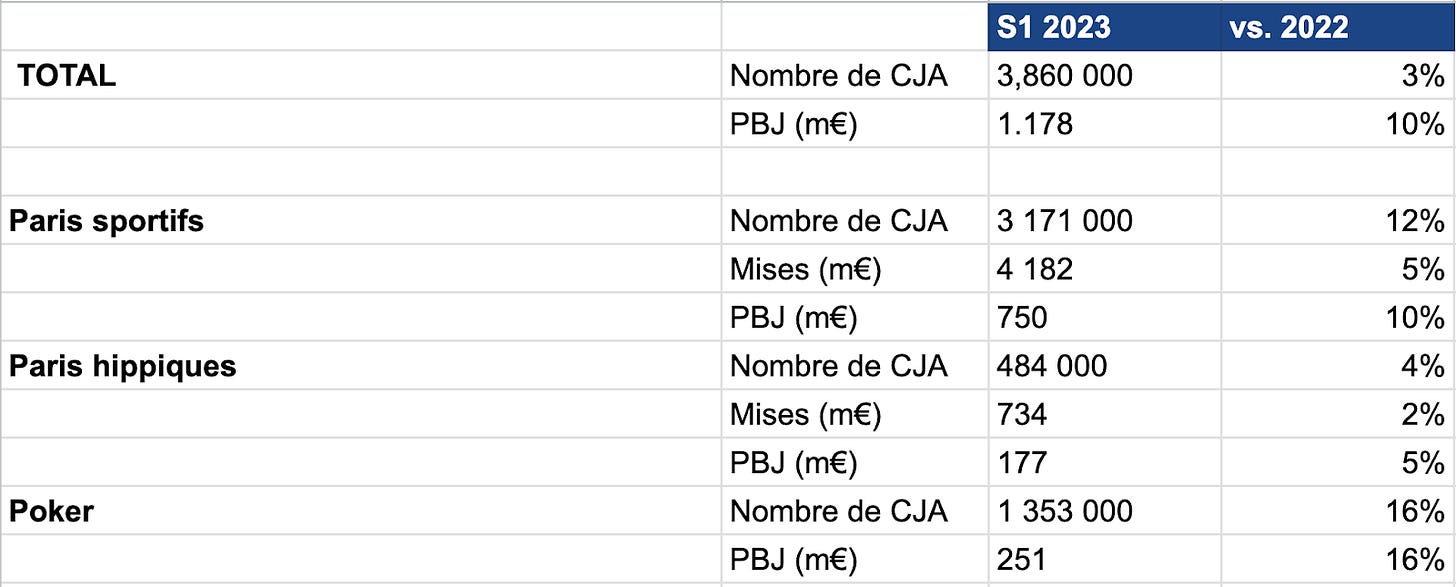

During H1, digital GGR grew 10% YoY to almost €1.2bn.

OSB accounted for 64% of the total, online poker for 21% and horse racing pari mutuel for 15%. The number of active player accounts rose by 3% to almost 3.9 million during the period.

Breakdown: Online bookmakers recorded a 5% increase in stakes to almost €4.2bn and GGR of €750m, up 10% YoY. As indicated by ANJ, horse racing pari mutuel had a good period with bets up 2% to €734m and GGR up 5% to €177m. For online poker sites, both GGR and actvies were up 16% to €251m 1.3 million ) were both up 16% respectively.

ANJ numbers:

French financial watchdog: report on gambling

France’s Cour des comptes, the country’s financial watchdog, examined key issues pertaining to the sector and in particular contrasted the recent performances of FDJ and PMU.

Key themes: These included the blurred lines between physical and online gambling, the need to define the legal framework for gaming-related NFTs, the influence of the ‘grands parieurs internationaux’ (international betting syndicates) on PMU and other important, France’s Cour des comptes published a comprehensive report on the country’s gambling industry at the end of last week.

Among its recommendations, it called for:

"A biennial summary of the effects of taxation on operators' GGR" by the Ministry of finance and other public bodies,

FDJ should, "within the framework of the close control exercised by the State", define its objectives and "ensure the coherence" of its 2025-30 strategy,

Giving the ANJ the power to sanction illegal operators directly,

Setting out the legal regime for gambling that included NFTs, cryptocurrencies and other web3 tools, and

the strengthening of ID verification systems in lottery and betting retail outlets, by potentially introducing a "Player’s Card" similar to what has been introduced in Sweden and Norway.

Blurred lines: The report also looked at the "increasingly blurred lines between online and brick-and-mortar gambling" and said that the convergence of formats "calls into question the distinction between brick-and-mortar and online gambling, which is the basis of the current regulations".

The document adds that ANJ is drawing the benefit of a regulatory framework that needed to be broadened in 2019. ANJ came into being in 2019 at the same time as the privatisation of the FDJ, which the report says has been a success for the French State.

The French government received €2.4bn from the privatisation and a €48.5m dividend in 2022 thanks to its 20% stake in FDJ.

Praising the work of ANJ since 2019-20, the report called for it to set up "a multidisciplinary monitoring, collection, analysis and research centre specialising in gambling" in 2024.

Mutual racing

With regard to PMU, the report says the group is "seeking to renew its customer base by attracting new generations of punters", but also focused on the fact that PMU records more than 10% of its stakes, €728m in 2021, through large international betting syndicates called “grands parieurs internationaux” (GPI).

Small amounts, big volumes: GPI bets are placed through PMU's commercial partners and are made up of "a considerable number of low-value bets on numerous races".

The court estimates the average rate of return for GPIs is 91% compared with 72% for regular punters. "Their profitability is assured", it adds, and exceeds 100% "thanks to the substantial discounts granted to them by their partners".

"Regime needs to be reviewed": The status of GPIs “needs to be be reviewed" because they have access to much broader and powerful datasets and algorithms than regular players, and their bets form part of "the group's retail betting pool".

The practice raises a number of issues, because of the impact on prices and returns and "in terms of fairness between punters".

The court called for a "convergence of the regime applied" to GPIs "with that for online betting" : for the GPI liquidity to be merged with PMU’s online pools.

Double cannibalisation: Contrasting the recent performances of the country’s ‘historic’ operators, the report says FDJ's retail betting segment has enjoyed seen strong growth since 2013 and has tripled since 2018 to reach €3.6bn in 2021, while PMU’s horse betting turnover has fallen from €8.4bn in 2010 to €5.8bn in 2020.

According to the report, this "cannibalisation" is due to two effects: In 2018 FDJ’s average payout ratio increased from 75.5% to 76.5% and made its retail bets more attractive at the same time as it reduced the appeal of PMU’s offer, while

FDJ retailers enjoy commissions that are 3.5 bsps higher than those paid by PMU.

Further reading (in French): The report (or parts of it) is worth reading/Google translating if you can.

Canal+ will not bid for Ligue 1 TV rights

The channel is unhappy and criticises LFP for its treatment.

Not candidates: Canal+ will not bid for the TV rights to Ligue 1. According to L'Équipe, the group sent a letter to the Ligue de Football Professionnel on Monday informing it that it would not be taking part in the call for tenders scheduled for 17 October and covering the period 2024-2029.

This will be the first time since its launch in 1984 that Canal+ will not attempt to win the TV rights to the French football championship.

Canal+ had announced that it wanted to "withdraw from Ligue 1" in 2021, mainly because the group felt mistreated by the LFP following the League's agreement with Amazon.

Direct elimination: According to Maxime Saada, CEO of Canal+, the LFP has already made Amazon its TV partner for the next few years "by displaying such high reserve prices (€530m for premium matches, €270m for the other lots)” in order to eliminate other bidders, explained L'Équipe.

Recall, sports streaming specialist Dazn, which launched in France this summer following a deal with Canal+, said it will be one of the candidates for the Ligue 1 TV rights.

French football currently receives just over €700m in domestic and international TV rights, and LFP president Vincent Labrune recently expressed his desire to see the figure rise to €1bn.

Entain down on Q3

Drag down: Entain said responsible gambling measures and lower growth in some key markets have acted as a drag on its performance and that net revenues will fall short of expectations in Q3.

Unfavourable sports results and lower activity in Australia and Italy also contributed to the less-than-optimal performance.

However the group praised its digital activities such as BetMGM in the US as well as the contribution of recent acquisitions such as SuperSport in Croatia and STS in Poland.

News in brief

Unibet will be the official betting partner of the Professional Fighters League Europe MMA playoffs taking place in Paris this weekend.

Genius Sports has launched BetVision with Caesars Sportsbook and Fanatics Sportsbook in the US. The product allows punters to place bets at the same time as they watch live NFL games on their sportsbook apps. According to the group, BetVision integrates live streams, bet slips and all event statistics in real time.

EveryMatrix has received the Safer Gambling certification from the World Lottery Association (WLA). The group said it was the first igaming provider to be awarded the certificate.

Contact

Contact Jake Pollard to find out more about Gaming&Co: jake@gamingandco.info